workers comp taxes texas

Vary each year as adopted by the Texas Department of Insurance. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

When Can Independent Contractors Get Texas Workers Comp

Helping Texas workers with.

. 512-676-6710 Property and Casualty Lines Office. However retirement plan benefits are taxable if either of these apply. Refer to 28 TAC Rule 1414 and our publication Insurance Maintenance Tax Rates and Assessments on Premiums.

The maximum Comp Rate for TIBs is currently 91300. Injuries are not covered if they were the result of the employees. For the most part you will not have to list workers compensation settlement money as income when filing your taxes.

Texas workers compensation law has caught up to these types of. The Texas Department of Insurance is working hard to provide you with information you need to make informed choices about workers compensation insurance. Requires all employers with or without workers compensation insurance coverage to comply with reporting and notification requirements under the Texas Workers Compensation Act.

Texas Workers Compensation laws are complex and impact many areas of an injured workers life and future. Workers Compensation Waxahachie 972 664-1117. The quick answer is that generally workers compensation benefits are not taxable.

The Texas Workforce Commission indicates that the effective tax rate in 2019 ranges from a minimum of 036 paid by 656 of employers to a maximum of 636 paid by 53 of employers for experienced-rated accounts and the average experience tax rate is 106. To limit or dispute your medical care and your entitlement to income benefits. Insurers licensed by the Texas Department of Insurance and self-insurance groups that write workers compensation insurance coverage must pay this tax.

Limitations of Workers Comp Benefits. Helping Texas workers with. Minimum Tax Rate for 2022 is 031 percent.

Up to 25 cash back Workers comp will also pay up to 10000 for burial expenses. Provides for reimbursement of medical expenses and a portion of lost wages due to a work-related injury disease or illness. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

Under workers compensation law an injury or illness is covered without regard to fault if it was sustained in the course and scope of employment ie while furthering or carrying on the employers business. Benefits are available only. Most people wont have to pay taxes on workers comp benefits.

You will typically not have to pay taxes on a workers compensation settlement at the state or federal level in Texas. Workers Compensation Texas Law. This includes injuries sustained during work-related travel.

Workers Compensation Richland Hills 817 605-0566. Workers Compensation Trussville 205 543-1210. Below you will find brief explanations of how the Comp Rate is determined.

Texas law does not deem compensatory damages awarded for bodily. Helping Texas workers with. The Comp Rate may vary based on what type of income benefits you are receiving and your Date of Injury.

Your taxable wages are the sum of the wages you pay up to. You retire due to your occupational sickness. Helping Texas workers with.

Call an Experienced Workers Compensation Attorney Today. The deadline is nearing for first responders to request that their COVID-19 claim be reconsidered. If you have any questions please contact eFiling-Helptditexasgov or call Rebekah Capelo at 512-804-4377.

Maximum Tax Rate for 2022 is 631 percent. If your claim was initially denied between March 13. If you have any questions comments or suggestions about this rate guide we would like to hear from you.

If you are receiving workers compensation benefits and have questions or concerns about which portion if any is taxable please contact Sutliff Stout at 281-853-8446 today. The texas division of workers compensation dwc reported that 28 of private companies in the state do not carry workers compensation insurance. In General Workers Comp Settlements Are Not Taxable.

Do you claim workers comp on taxes the answer is no. Helping Texas workers with. As you can see there are limits to workers comp benefits.

You pay unemployment tax on the first 9000 that each employee earns during the calendar year. Youll receive only a portion of your lost wages although it may help to learn that workers comp benefits are generally tax-free. Call 888-434-COMP 888-434-2667.

In most cases they wont pay taxes on workers comp benefits. The insurance carrier has one goal. We can also be reached via text message and email.

We are working with our phone company to resolve this issue as quickly as possible. Workers Compensation Wylie 214 379-7554. In addition you cant receive any payment for the.

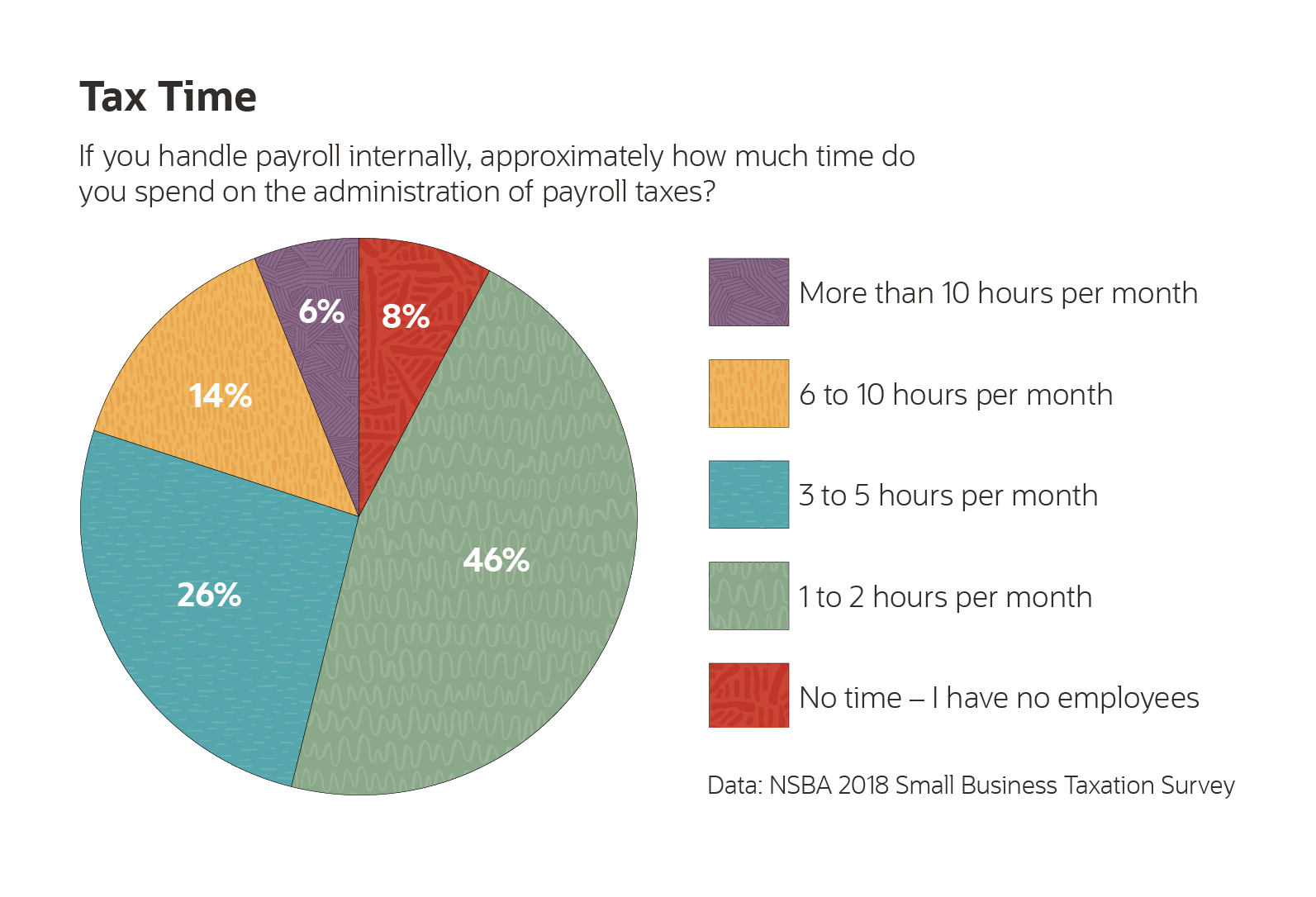

Temporary Income Benefits TIBs The Comp Rate will be calculated at 70 of your Average Weekly Wage. In addition to fica taxes you must also cover unemployment taxes and workers compensation.

Texas Payroll Services Resources Quickbooks

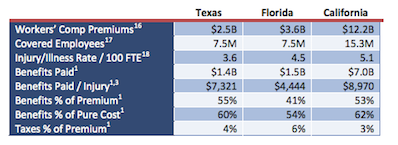

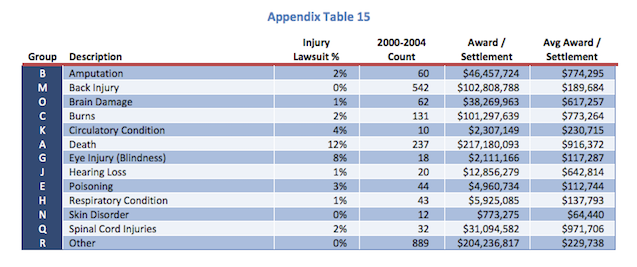

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

Texas Workers Compensation Insurance Laws Forbes Advisor

Is Workers Comp Taxable Hourly Inc

2022 Federal State Payroll Tax Rates For Employers

Texas Workers Compensation Laws Costs Providers

Fica Taxes Unemployment Insurance Workers Comp For Owners

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

Texas Non Subscriber How Can Injured Worker S Get Compensation

The Complete Guide To Texas Payroll Taxes 2022

Are The Benefits From Workers Compensation Taxable In Texas D Miller

Is Workers Comp Taxable Hourly Inc

Is Workers Comp Taxable Workers Comp Taxes

Workers Compensation In Texas A Brief History International Development 18 Th Century Pirates 1 If You Survived The Injury No Death Benefits Loss Ppt Download

Understanding The Costs Behind Small Business Payroll Netsuite

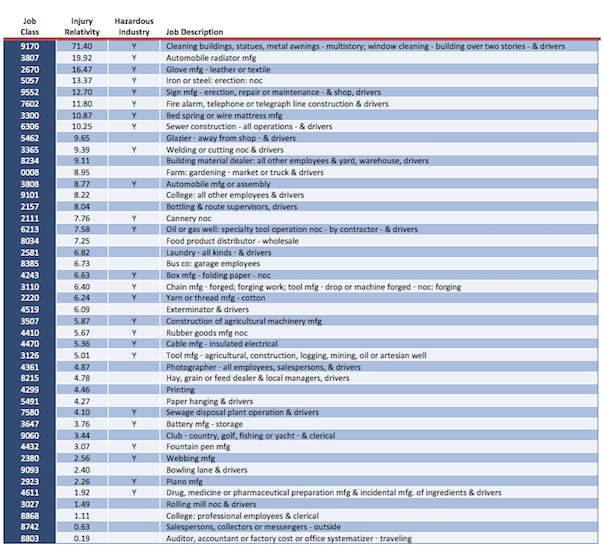

Price Check How Companies Value Body Parts

The True Cost To Hire An Employee In Texas Infographic

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation